(+) Swing Trade Strategies

♞ Introduction to Swing-Trading Strategies

Swing traders are among the most profitable non-professional Forex traders. Swing trading involves opening and closing positions that last from 2 to 5 days, typically targeting profits of 200–500 pips per trade. Swing traders usually aim for a profit/loss ratio greater than 2, often exceeding 3.

🛠 Swing-Trading Strategy Characteristics

Since swing traders remain in the market overnight, they must take swap charges from their broker very seriously. Swap fees are often more important than the spreads between ask and bid for this trading style. Additionally, swing traders need to consider upcoming news events carefully, as staying in the market for 4–5 days exposes them to multiple news releases that can significantly impact market conditions.

■ Weekly Trades: 1 - 3 trades per week

■ Profit/Loss Ratio: 2.5 – 5.0

■ Leverage: 1:3 to 1:10

■ Spreads: not very important 1 - 10 pips

■ Slippage: irrelevant

■ Overnight Charges: Very Crucial (choose brokers offering the best terms)

■ Upcoming News: Very important

♔ List of Swing-Trading Strategies

|

TRADING STRATEGIES |

ASSET AND TIMEFRAME |

INDICATORS AND SETUP |

TAKE PROFIT AND STOP-LOSS |

MORE INFO |

|

TRADING THE MOVING ENVELOPE |

■ H1 timeframe (1-Hour) ■ All Forex Majors ■ Metals and Energy ■ Stocks & Indices |

Two SMA: 1. SMA-1 (9): 2. SMA-2 (21) ADX Settings Default settings: (ADX 14) |

■ Take Profit: 240-300 pips ■ Stop-Loss: 80-100 pips ■ Profit/Loss Ratio: 3 |

|

|

MACD SWINGER STRATEGY |

■ H4 timeframe (4-Hour) ■ All Forex Majors ■ Metals and Energy ■ Stocks & Indices |

MACD Settings The default settings Note: You can alternatively combine MACD with RSI or Stochastic |

■ Take Profit: 300-400 pips ■ Stop-Loss: 150-200 pips ■ Profit/Loss Ratio: 2 |

|

|

RIDING THE TREND STRATEGY |

■ H1 timeframe (1-Hour) ■ All Forex Majors ■ Metals and Energy ■ Stocks & Indices |

Determining the Trend Using the simplest definition of trend formation. Stochastic Setting Stochastic at (12,3,3) |

■ Take Profit: pips 100 pips ■ Stop-Loss: Pips 40-50 pips

■ Profit/Loss Ratio: 2 |

◙ Swing-Trading Strategies

ForexExperts.net ©

| 🔗 READ MORE | » Introduction to Trading Strategies | |||

| ♞ DAY-TRADE STRATEGIES | » Falsebreak Candle | » Bollinger-RSI | » Stochastic Day-Trade | » Breakout Strategy |

| ♚ SWING-TRADE STRATEGIES | » Riding the Trend | » Moving Envelopes | » MACD Swing | |

| ♜ SCALPING STRATEGIES | » Stochastic Scalper | » Bollinger-RSI Scalping | » Hit-Run Trading | |

| ♟ STRATEGIES FOR BEGINNERS | » News-Trading | » Follow-The-Trend | » Support and Resistance | » Fibonacci Retracements |

| » Stochastics Trading | » Chart Patterns | |||

| 💱 MARKET CORRELATIONS | » US Yields and USDCHF | » Crude Oil and Forex | » USDJPY and US Stock Indices | » AUD and Gold Price Correlation |

RIDING THE TREND TRADING STRATEGY

Following the master trend is the wisest strategy, whether you are a day-trader or a swing-trader.

TRADING STRATEGY

TRADING STRATEGY

■ Style: Swing Trade Strategy

■ Name: Riding the Trend Trading Strategy

FINANCIAL ASSETS

■ Forex Majors | ■ Metals and Energy | ■ Stocks | ■ Indices

TIMEFRAME

TIMEFRAME

■ H1 timeframe (1-Hour)

INDICATORS & SETUP

INDICATORS & SETUP

This strategy uses a simple model for trend determination combined with the Stochastic indicator.

■ Determining the Trend

To identify the trend, we use the simplest definition of trend formation.

⬆️ Rising Trend:

A trend is rising when a local high is higher than the previous high, and at the same time, the recent low is higher than the previous low.

⬇️ Falling Trend:

A trend is falling when a local low is lower than the previous low, and at the same time, the recent high is lower than the previous high.

■ Stochastic

At a Glance: The Stochastic Oscillator

The Stochastic Oscillator measures a currency pair's closing price relative to its price range over a specified period—typically 14 days. It generates two lines, %K and %D, which oscillate between 0 and 100. This indicator helps identify overbought conditions (above 80) and oversold conditions (below 20), signals momentum shifts through line crossovers, and highlights potential reversals by spotting divergences between price action and the oscillator.

Settings:

- %K period = 12, %D period = 3, Slowing = 3

- Note that the standard settings are (14,3,3)

TRADING SIGNALS

TRADING SIGNALS

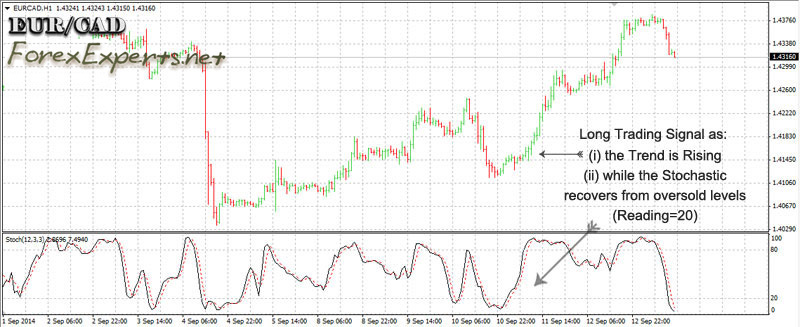

This is how you can implement the Riding-the-Trend Strategy:

■ (↑) Long Trades

-

Identify a new uptrend using the simple definition:

“The new high is higher than the previous high, and the recent low is higher than the previous low.” -

Confirm that the Stochastic is recovering from oversold levels around 20, then enter a long trade.

■ (↓) Short Trades

-

Identify a new downtrend using the simple definition:

“The new low is lower than the previous low, and the recent high is lower than the previous high.” -

Confirm that the Stochastic is falling from overbought levels near 80, then enter a short trade.

TRADING ORDERS

TRADING ORDERS

■ Take Profit: 100 pips

■ Stop-Loss: 40-50 pips

■ Profit/Loss Ratio: 2

CHART: Riding the Trend Strategy

■ Riding the Trend Trading Strategy

ForexExperts.net ©

🔗 READ MORE

» Introduction to Trading Strategies

♞ DAY-TRADE STRATEGIES

» Falsebreak Candle

» Bollinger-RSI

» Stochastic Day-Trade

» Breakout Strategy

♚ SWING-TRADE STRATEGIES

» Riding the Trend

» Moving Envelopes

» MACD Swing

♜ SCALPING STRATEGIES

» Stochastic Scalper

» Bollinger-RSI Scalping

» Hit-Run Trading

♟ STRATEGIES FOR BEGINNERS

» News-Trading

» Follow-The-Trend

» Support and Resistance

» Fibonacci Retracements

» Stochastics Trading

» Chart Patterns

💱 MARKET CORRELATIONS

» US Yields and USDCHF

» Crude Oil and Forex

» USDJPY and US Stock Indices

» AUD and Gold Price Correlation

THE MOVING ENVELOPES TRADING STRATEGY

Moving averages can be a great tool for identifying the master trend and signaling trades by using Moving Average Envelopes.

TRADING STRATEGY

TRADING STRATEGY

■ Style: Swing Trading Strategy

■ Name: Trading the Moving Envelopes Strategy

FINANCIAL ASSETS

■ Forex Majors | ■ Metals and Energy | ■ Stocks | ■ Indices

TIMEFRAME

TIMEFRAME

■ H1 timeframe (1-Hour)

INDICATORS & SETUP

INDICATORS & SETUP

This strategy uses two Moving Averages and the ADX.

To create the envelope, you need two simple moving averages (SMAs). Any signal generated by the SMAs is confirmed using the Average Directional Movement Index (ADX).

1. Two SMAs (Two Simple Moving Averages)

Settings:

- SMA-1 (fast): choose 9 periods

- SMA-2 (slow): choose 21 periods

2. ADX

At a Glance: ADX

The ADX (Average Directional Index) measures the strength of the trend (not direction) on a scale from 0 to 100. Values below 20 suggest a weak or sideways market, readings above 25 indicate a strengthening trend, and levels above 40 reflect strong momentum. It is commonly used alongside the +DI and –DI lines to determine the trend’s direction.

Settings:

- MetaTrader-4 default settings (ADX 14)

- Level 40 is added

TRADING SIGNALS

TRADING SIGNALS

This is how you can implement the Trading the Moving Envelopes Strategy:

■ (↑) Long Trades

If the fast SMA (9 periods) crosses above the slow SMA (21 periods), you get a buy signal. Confirm this signal with a falling ADX, which indicates decreasing market volatility—often a positive sign for an upcoming bullish trend.

■ (↓) Short Trades

If the slow SMA (21 periods) crosses above the fast SMA (9 periods), you get a sell signal. Confirm this signal with a rising ADX, which indicates increasing market volatility.

TRADING ORDERS

TRADING ORDERS

■ Take Profit: 240-300 pips

■ Stop-Loss: 80-100 pips

■ Profit/Loss Ratio: 3

CHART: MOVING ENVELOPES (EURUSD)

■ Trading the Moving Envelopes Trading Strategy

ForexExperts.net ©

🔗 READ MORE

» Introduction to Trading Strategies

♞ DAY-TRADE STRATEGIES

» Falsebreak Candle

» Bollinger-RSI

» Stochastic Day-Trade

» Breakout Strategy

♚ SWING-TRADE STRATEGIES

» Riding the Trend

» Moving Envelopes

» MACD Swing

♜ SCALPING STRATEGIES

» Stochastic Scalper

» Bollinger-RSI Scalping

» Hit-Run Trading

♟ STRATEGIES FOR BEGINNERS

» News-Trading

» Follow-The-Trend

» Support and Resistance

» Fibonacci Retracements

» Stochastics Trading

» Chart Patterns

💱 MARKET CORRELATIONS

» US Yields and USDCHF

» Crude Oil and Forex

» USDJPY and US Stock Indices

» AUD and Gold Price Correlation

Rating Formula Comparisons

Trade Strategy

Forex Brokers

💡 Forex Ratings

Forex Broker Ratings Powered by the Next-Generation RatingFormula 5.0 (?)

Forex Broker Ratings Powered by the Next-Generation RatingFormula 5.0 (?)

The RatingFormula series, developed by George M. Protonotarios, is designed to bring objectivity to online corporate ratings. In the future, search engines and various applications are expected to adopt similar rating algorithms to accurately assess the true value of online corporations for users and rank them accordingly in search results.