AUDUSD and Gold Price Correlation

■ AUDUSD has a positive correlation with Gold

■ AUDUSD has had an 80% historical correlation to the Gold Price

🦘 Why the Australian Dollar is Correlated to Gold?

The Australian Dollar against the US Dollar is highly correlated with the gold price for several reasons:

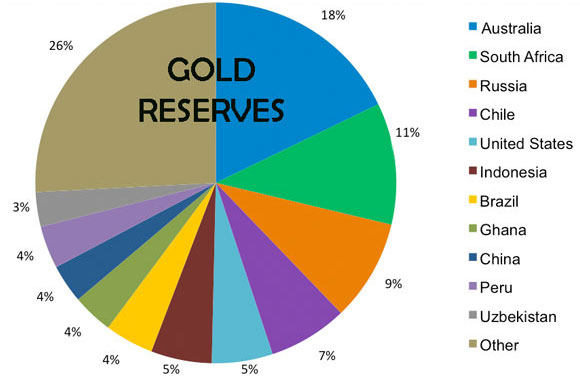

📌 Australia is a major gold producer, accounting for 9.4% of global production

📌 Australia’s gold reserves, at 9,800 tonnes, represent 18% of global reserves.

📌 The gold price is typically negatively correlated with the US Dollar.

Chart: Global Gold Resources

Source: United States Geological Survey (USGS)

🪙 The Australian Gold Production

The correlation between the Aussie and gold price is mainly driven by Australia’s domestic gold production. The country’s annual gold exports are valued at around 5 billion USD. Note that China is the world’s largest gold producer, followed by South Africa. Australia is also a major exporter of uranium, coal, and other metals.

Additionally, Australia holds the largest gold reserves globally. South Africa ranks second with 6,000 tonnes, followed by Russia in third place with 5,000 tonnes.

Chart: Australian Dollar vs US Dollar and Gold Price Correlation (2011-2016, Price Feed: Google Finance)

🎯 The Advantage of Going Long on AUDUSD than Buying Directly Gold

Over the long term, the Aussie tends to follow similar price patterns as gold. Many traders prefer going long on AUD/USD rather than buying gold contracts directly, and for good reason. Gold does not offer any interest rates. Additionally, going long on a gold contract usually incurs an overnight fee (negative swap). In contrast, the Aussie against the US Dollar offers a positive swap value, meaning it pays you an overnight interest.

Forex Brokers and AUD/USD Swap Rates

According to ForexExperts.net research, here are some positive AUD/USD swap rates (when going long) offered by various Forex brokers:

Table: AUD/USD Overnight Swaps (note that the following figures may change by the day)

➕ Gold Correlation to Swiss Franc

The gold price is also correlated with USD/CHF, as about 25% of Swiss money is backed by gold reserves.

■ Gold has a negative correlation with USD/CHF

🔄 Other Australian Dollar Correlations

- Over the past two decades, the correlation between copper and the AUD has exceeded 70%.

- The Aussie is also correlated with silver and other commodities.

- Additionally, the Aussie is highly correlated with the New Zealand Dollar, with a correlation above 90%.

■ Australian Dollar and Gold Price Correlation

ForexExperts.net