The RatingFormula 5.0

The RatingFormula 5.0

The Rating Formula Series is a concept developed by George M. Protonotarios to objectify online corporate ratings. In the near future, search engines are expected to use similar rating algorithms to assess the true value of online corporations for users and rank them accordingly in search results.

How the Forex Rating Formula 5.0 Really Works

The Forex Rating Formula 5.0 operates by analyzing and scoring brokers based on a structured set of criteria. It combines quantitative and qualitative data to ensure objective, consistent, and transparent evaluations. The formula is designed to adapt across trader profiles, factoring in key elements such as regulation, cost efficiency, technology, and user experience. By weighting these elements according to trader type (beginner, experienced, institutional) and trading style (scalping, swing, long-term), the system delivers personalized and relevant ratings for each broker.

The Mission:

The Mission:

“Ensuring the safety of funds, minimizing transaction costs, and providing state-of-the-art technology”

The 4 rating factors included in the Rating Formula and their weight:

- Factor -(A) Safety of Funds (28.00%)

- Factor -(B) Transaction Cost (28.00%)

- Factor -(C) Variety of Trading Options (28.00%)

- Factor -(D) Technology (16.00%)

Explaining the 4-Factor Rating Model

This is a detailed analysis of the four rating factors that make up the new Rating Formula 5.0.

(A): Safety of Trading Funds, (28.0%)

A.1 Level of Regulation, (10.00%)

Reliable regulation by a trusty government authority reduces the risk of any broker misbehaving. Regulation is an important issue for all trading styles.

A.2 Trader Compensation in Case of Insolvency, (5.00%)

The ability of a broker to compensate its clients in case of insolvency is very important regarding the safety of trading funds.

A.3 Headquarters Country, (5.0%)

The country of headquarters determines the reliability of any corporate balance sheet. The Rating Formula rates favorably countries implementing strict policies regarding corporate entities, especially as concerns the financial sector. Brokers domiciled in offshore countries will not receive any rating points.

A.4 Years of Operation in the Market, (5.0%)

The long existence of a corporation in the industry highlights a successful business model and the proven ability to manage business risk over time. Based on empirical evidence, most of the fake financial firms operate in the market for less than 2 years. Brokers that operate for less than 2 years will not receive any rating points. Brokers that operate for more than 10 years will receive all rating points.

A.5 Client Bank Account Segregation, (2.50%)

Bank account segregation is a process when a customer’s funds are held separately from the funds of a brokerage firm. The existence of client bank account segregation enforces the transparency of the accounting process and adds value in terms of funds' safety.

A.6 Web Ratings, (0.50%)

Adding an external rating score works as a tool for differentiating the overall results of the Rating Formulas. The Rating Formula 5.0 incorporates the web ratings of the trustable ForexPeaceArmy.

A.7 Adjustments

A.7.1 Accounts Size, (+1.00%)

Large companies tend to fall harder than smaller ones. Forex brokers maintaining a large client base get an additional rating of up to 1.0%.

(B): Transaction Cost (28.0%)

B.1, B.2, B.3 Spread on the three Most Traded Pairs: EURUSD, GPBUSD, and USDJPY (16.00%)

EURUSD, GPBUSD, and USDJPY are the most traded pairs in the Forex market. Almost all Forex traders trade often at least one of them. If a Forex Broker charges expensive spreads on these three (3) pairs it is almost certain that it will charge expensive spreads on every other Forex pair.

(+) Smart Filter:

If the trading spread on EURUSD exceeds 4.0 pips then automatically the B.4 rating (which involves trade commission) receives zero (0) value. This is happening as a very high spread eliminates the advantage of not paying trading commissions.

B.4 Trading Commissions per Round Lot, (7.00%)

Forex Brokers charging low trading commissions achieve better rating scores. Note that the trading commissions are calculated on a full (round) traded lot basis.

(+) Smart Filter:

If the trading commissions exceed $25/full traded lot then B.1, B.2, and B.3 ratings receive zero (0) values. This is happening as extremely high trading commissions eliminate the advantage of tight or even zero spreads.

B.5 Overnight Fees, (2.00%)

Two virtual overnight trades are used:

(↑) $100,000 overnight long position on EURUSD

(↓) $100,000 overnight short position on EURUSD

The overnight cost of both positions combined will be always negative and therefore we can use the absolute value of the sum (||).

■ Absolute Value of the total overnight cost, where

■ Total overnight cost (in USD) = {overnight cost of a Long Position worth 1 lot + overnight cost of a Short Position worth 1 lot}

B.6 Funding Fees, (2.00%)

Funding fees and commissions reduce the availability of trading funds. The Rating Formula rates unfavorably any commissions or fees charged on deposits or withdrawals (not including fees charged by third parties).

B.7 Inactive Fees, (1.00%)

Some Forex brokers may charge fees for inactive accounts. Usually, this is happening after 90 days of no trading activity. This means extra costs for traders. The Rating Formula 5.0 rates unfavorably brokers charging such fees.

B.8 Adjustments

B.8.1 Order Execution Model, (+2.00%)

The execution model of every broker is crucial as it affects the cost and the speed of order execution. An ECN/STP broker (NDD) offers in general better trading conditions than a Dealing Desk (DD) firm.

(C): Trading Options (28.0%)

C.1 Currency Pairs Index, (8.00%)

The greater the number of currencies contained in an asset index the higher the potential for Forex traders to exploit trade opportunities.

C.2 CFD Trading, (2.50%)

The availability of CFD trading may cover extended trading needs. The Rating Formula 5.0 rates favorably CFD trading on MT4 more than CFD trading on a simple web trader.

C.3 Futures or CFDs on Futures, (1.50%)

The availability of Futures or CFDs on Futures is very useful for all traders. Note that these types of trading instruments do not involve any overnight cost and that makes them ideal for swing traders.

C.4 Practice Account, (2.00%)

The existence of a Demo / Practice Account can help traders to get familiar with a Forex broker before risking their funds and before devoting their precious time. It is useful for all traders no matter their level of experience.

C.5 Level of Capital Leverage, (1.00%)

The use of Capital Leverage adds flexibility to trading strategies. On the other hand, Capital Leverage adds more risk and more transaction costs. Therefore, the rating weight of Capital Leverage is limited to 1.0%.

C.6 Promotions (Bonus / Rebates), (5.00%)

C.6.1 Welcome Bonus

-Cash Bonuses receive 100% of the rating points

-Credit Bonuses receive 50% of the rating points

C.6.2 Trading Rebates

A rebate plan is a cash-back process based on volume activity. Traders receive cashback for every position they open and close.

C.7 Minimum Deposit, (2.00%)

The lower the minimum deposit required the easier for a trader to test the real trading conditions of a Forex broker.

C.8 Number of Deposit Methods, (2.50%)

Traders who are able to fund their new account via their custom fund method can save precious time. The more fund methods are available, the better for traders.

C.9 Number of Withdrawal Methods, (2.50%)

Most Forex brokers allow traders to withdraw their funds using the same method as when they deposited funds. Nevertheless, some brokers offer less withdrawal than deposit methods. This explains why C.9 forms a separate rating factor.

C.10 Minimum Stop-Order Levels (1.00%)

The minimum stop-order distance requirement is very important for many Forex trading styles, including scalpers, day traders, and news traders. Forex brokers allow tight stop-order levels to receive better ratings.

C.11 Adjustments

C.11.1 Providing 100+ Forex Pairs (+1.00%)

Forex brokers offering more than 100 Forex pairs achieve better ratings.

C.11.2 Interest on Deposited Funds, (+0.50%)

Forex brokers offering interest on unused funds achieve better ratings.

C.11.3 Trading Championships, (+0.25%)

A trading contest can prove a free educational tool for beginners. On the other hand, advanced and professional traders can even make some money by trading in a contest, without risk. Forex brokers offering free contests achieve better ratings.

(D): Technology (16.0%)

D.1 Number of Trade, (3.00%)

A wide variety of trading platforms provides Forex traders with more options.

D.2 Trading-on-Charts, (1.00%)

The convenience of trading from a chart can prove very useful for all Forex traders. Trading-on-charts involves the placement of pending orders, stop levels, and take-profit levels.

D.3 Slippage on Execution, (1.00%)

High slippage on order execution means more cost for Forex Traders, especially as concerns scalpers and news traders.

D.4 Automated Trading, (2.00%)

Automated trading and Expert Advisors (EAs) are a common practice for Forex Traders nowadays. All Forex brokers should allow it.

D.5 MetaTrader, (2.00%)

MetaTrader-4 is the undisputed Forex industry standard. Most Forex traders are familiar with MetaTrader. In addition, many technical analysis tools (indicators, EAs, etc.) are designed exclusively for the MT4 platform.

D.6 Mobile Traders, (2.00%)

Mobile trading is the future of trading. Forex brokers should provide specialized apps for all popular mobile platforms, especially as concerns iOs and Android.

D.7 Scalping / Hedging, (1.00%)

Allowing Scalping and Hedging provides more flexibility. All Forex brokers should allow them.

D.8 Customer Support, (4.00%)

Online trading requires the existence of reliable and fast customer service. The Rating Formula rates the availability of customer service (24/7, 24/6, or 24/5) but also the variety of customer support methods (email, phone, live chat, skype, and forum).

D.9 Adjustments

D.9.1 PAMM / MAM Accounts, (+0.50%)

MAM (Multi-Account Manager) and PAMM (Percentage Allocation Management Module) are account types allowing fund managers to control multiple trade accounts from their own single account.

D.9.2 Free VPS, (+0.50%)

A VPS (Virtual Private Server) is a service provided by Forex Brokers that allows traders to run their EAs (expert advisors) on a dedicated server that works 24/7 without interruptions, and without the need of the trader’s own computer.

D.9.3 API Trading, (+0.50%)

API (Application Programming Interface) refers to a software program that works as a bridge connecting two different trading frameworks. The API interface links easily traders using a trading platform with the liquidity providers of the broader currency market. A trading API indicates a Forex broker focusing more on state-of-the-art trading technology.

Additional Categories of Rating Scores

The Forex Rating Formula 5.0 can generate a wide range of additional rating scores. These alternative scores include:

(a) Three different trading styles:

■ Intraday, Swing, and Carry Trading

(b) Three different levels of trading experience:

■ Beginners, Advanced, and Professional Traders

Compare Ratings

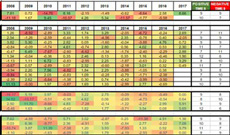

These are the first rating reviews based on RatingFormula 5.0

| COMPARE FOREX BROKER RATINGS | RATING PAGE | VISIT | |||||

| Overall Rating | 1.Funds Safety | 2.Competition | 3.Trading Options | 4.Technology | |||

| AXI | 84.6% | 90.4% | 79.5% | 78.6% | 93.8% | » AXI Rating | » AXI Website |

| DUKASCOPY BANK | 81.6% | 99.5% | 78.6% | 65.2% | 84.4% | » Dukascopy Bank | » Visit Dukascopy |

| IC MARKETS | 80.6% | 70.9% | 79.5% | 80.4% | 100.0% | » ICMarkets Rating | » Visit ICMarkets |

| DUKASCOPY EUROPE | 75.6% | 67.4% | 78.6% | 75.9% | 84.4% | » Dukascopy Europe | » Visit Dukascopy |

| FBS | 65.8% | 27.0% | 62.5% | 88.4% | 100.0% | » FBS Rating | » Visit FBS |

| ETORO | 61.7% | 79.3% | 32.1% | 73.2% | 62.5% | » eToro Rating | |

► The RatingFormula 5.0 at TradingCenter.org

■ Forex Rating Formula 5.0

By George M. Protonotarios, Financial Analyst –MSc in “International Banking & Finance”

(c) ForexExperts.net, Qexpert.com

🔗 MORE RATINGS

» RoboForex Rating

» TitanFx Rating

» IC Markets

» FxOpen

» FBS Group

» AXI Rating

» Brokers Directory

» Auto-Trade Systems

» Rating Forex Brokers