EURJPY STATISTICS & RESEARCH

The EUR/JPY pair consists of two reserve currencies—the Euro and the Japanese Yen. It is correlated with USD/JPY and tends to perform better during the last two months of the calendar year, especially in December.

📈 EURJPY CHART

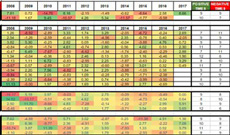

The following chart shows the average performance of EURJPY throughout the calendar year.

Chart: EURJPY Average Monthly Returns

Chart Source: ForexExperts (c)

(↑) BEST MONTHS FOR LONG EURJPY TRADES

The Best Months to go Long on EURJPY are:

→ December, +2.33% average returns {Times: 13↑ and 4↓)

→ November, +0.93% average returns {Times: 11↑ and 6↓)

→ March, +0.90% average returns {Times: 12↑ and 6↓)

(↓) BEST MONTHS FOR SHORT EURJPY TRADES

The Best Months to go Short on EURJPY are:

→ August, -1.31% average returns {Times: 5↑ and 13↓)

→ October, -0.92% average returns {Times: 9↑ and 81↓)

📊 DETAILED EURJPY STATISTICS 2000-2017

EURJPY statistics covering the period starting January 2000 and ending September 2017.

| SEMESTER | RETURN | TIMES (↑) | TIMES (↓) | VOLATILITY |

| A' SEMESTER | 0.39% | 10 | 8 | 1.03% |

| B' SEMESTER | 1.64% | 11 | 6 | 0.95% |

| MONTH | RETURN | TIMES (↑) | TIMES (↓) | VOLATILITY |

| JANUARY | -0.91% | 9 | 9 | 1.09% |

| FEBRUARY | 0.09% | 9 | 9 | 1.04% |

| MARCH | 0.90% | 12 | 6 | 1.06% |

| APRIL | 0.76% | 11 | 7 | 1.01% |

| MAY | -0.64% | 12 | 6 | 1.00% |

| JUNE | 0.32% | 11 | 7 | 1.00% |

| JULY | -0.15% | 8 | 10 | 0.89% |

| AUGUST | -1.31% | 5 | 13 | 0.90% |

| SEPTEMBER | 0.45% | 10 | 7 | 1.00% |

| OCTOBER | -0.92% | 9 | 8 | 1.04% |

| NOVEMBER | 0.93% | 11 | 6 | 1.01% |

| DECEMBER | 2.33% | 13 | 4 | 0.88% |

| QUARTER | RETURN | TIMES (↑) | TIMES (↓) | VOLATILITY |

| A' QUARTER | 0.07% | 9 | 9 | 1.06% |

| B' QUARTER | 0.45% | 11 | 7 | 1.00% |

| C' QUARTER | -1.01% | 8 | 10 | 0.93% |

| D' QUARTER | 2.34% | 12 | 5 | 0.98% |

| SEASON | RETURN | TIMES (↑) | TIMES (↓) | VOLATILITY |

| AUTUMN | 0.46% | 13 | 4 | 1.02% |

| WINTER | 1.50% | 9 | 9 | 1.00% |

| SPRING | 1.03% | 11 | 7 | 1.02% |

| SUMMER | -1.15% | 6 | 12 | 0.93% |

Source: ForexExperts.net

⚖️ COMPARE EURJPY BROKERS

Comparison between regulated EURJPY Forex Brokers.

|

EURJPY BROKER |

ROBOFOREX

|

ICMARKETS |

TITAN FX

|

|

SPREAD |

|

|

|

|

COMMISSIONS |

$4.0

/ full round lot |

$7.0 / full round lot |

$7.0 / full round lot |

|

PLATFORMS |

MT4, MT5, RstocksTrader

|

MT4, MT5, cTrader, cAlgo

|

MT4, MT5, WebTrader

|

|

LIQUIDITY |

|

|

|

|

REGULATION |

|

|

|

|

FUNDING |

Min Deposit: 10 USD

|

Min Deposit: 200 USD

|

Min Deposit: 200 USD

|

|

INFORMATION |

» TitanFx Rating | ||

|

STP BROKER |

ECN BROKER |

ECN BROKER |

◘ EURJPY Statistics

Giorgos Protonotarios, Copyright © ForexExperts.net