Forex Correlations

The Correlation Between US Bonds Yields and USDCHF

U.S. bond yields have historically shown a strong correlation with the USD/CHF currency pair.

Since 1990—and especially after 2007—global financial markets have increasingly functioned as a unified investment environment. This interconnected system allows capital to flow freely in pursuit of the most favorable risk/return balance. When a significant shift in the risk/return profile occurs in one market, other markets tend to respond quickly in an effort to restore equilibrium.

🏛️ U.S. Bond Yields: A Brief Historical Perspective

U.S. Treasury yields have mirrored major economic cycles—rising and falling in response to inflation, financial crises, and monetary policy shifts. Today’s yields, with the 10-year at 4.35% and the 30-year at 4.87%, are near their highest levels in over a decade, yet still fall short of long-term historical norms. The continued inversion of the yield curve reflects investor anxiety over potential recession risks, despite the Federal Reserve’s cautious stance.

Historical Milestones

-

1970s–1980s Inflation Era: Bond yields soared above 15% amid oil shocks and runaway inflation.

-

Post-1982: A long-term downtrend began as inflation was tamed and policy stabilized.

-

2008 Financial Crisis: Economic collapse drove yields to historic lows—10-year notes fell to around 2.32% between 2011 and 2012.

-

2022–2023 Inflation Resurgence: Rapid Fed rate hikes in response to rising prices pushed the 10-year yield up to 4.81%, marking a post-crisis peak as of 2025.

📈 The Relationship Between U.S. Bonds and USD/CHF

The underlying mechanisms of the bond and Forex markets are closely related, as both are strongly influenced by interest rate levels. Any changes in actual interest rates or expectations surrounding them lead to a reevaluation of risk and return across both asset classes.

U.S. bond yields have shown a historical correlation with USD/CHF. This is largely because the Swiss Franc—like the Japanese Yen—traditionally offers very low interest rates. When U.S. interest rates rise, investors are incentivized to go long on USD/CHF to capitalize on carry trade opportunities. In simple terms, they buy the U.S. Dollar and sell the Swiss Franc in order to benefit from the positive overnight interest rate differential.

Correlation Between USDJPY and Stock Indices

Historically, the American indices (S&P 500, DJIA, NASDAQ) tend to move in the same direction as USD/JPY (the U.S. Dollar against the Japanese Yen).

⇄ Defining Correlation in Finance

In general, correlation between two variables expresses an average relationship supported by historical data. The correlation coefficient ranges from -1.0 to +1.0, where:

+1.0 indicates a perfect correlation, reflecting identical movements or directions.

-1.0 indicates a perfect negative correlation, reflecting exactly opposite movements or directions.

📈 US Dollar Correlation Coefficient

Comparing the USDX (U.S. Dollar Index) against the Dow Jones Industrial Average over the past 20 years yields a correlation coefficient of approximately +0.35. This positive value means that the U.S. Dollar and DJIA generally move in the same direction. However, since the coefficient is only 0.35, just 35% of DJIA movements are linked to movements in the U.S. Dollar.

There is a good reason for this.

As demand for American stocks rises, demand for U.S. Dollars increases as well, because dollars are required to purchase U.S. stocks. Below, we will explore why the Forex pair USD/JPY is more closely correlated with U.S. equities than any other currency pair.

Crude Oil and Forex Market Correlation (USDCAD, CADJPY, USDRUB, USDNOK)

One of the most important Forex and commodity correlations exists between USD/CAD and crude oil.

The correlation between the Canadian dollar versus the U.S. dollar and oil prices is very strong. Historically, there has been a positive correlation of about 0.75 to 0.80 between USD/CAD and oil prices.

■ USD/CAD and Oil Price: 0.75–0.80 positive correlation

■ CAD/JPY and Oil Price: 0.80 positive correlation

There are also other crude oil and Forex correlations, including USD/RUB (U.S. Dollar vs. Russian Ruble), USD/NOK (U.S. Dollar vs. Norwegian Krone), and CAD/JPY (Canadian Dollar vs. Japanese Yen).

📊 Canada’s Crude Oil Production and Exports

Here are some key figures related to Canada’s crude oil production and exports:

- In 2024, Canada's crude oil production rose 4.3% to 1.88 billion barrels

- Canada's exports surged from 1.16 million barrels per day during 1980–2023 to a record 3.4 million barrels per day in 2023

- In 2024, the United States imported $103.3 billion worth of Canadian crude oil

- Canada’s primary heavy crude blend, typically trades at a $10–15/barrel discount to West Texas Intermediate (WTI)

- U.S. refiners benefit from an estimated $19 billion annually by purchasing discounted Canadian crude and exporting higher-value light crude from domestic sources

🛢️ Explaining the Negative Correlation Between the U.S. Dollar and Crude Oil

All commodities are priced in U.S. Dollars; therefore, there is generally a negative correlation between the U.S. Dollar and commodity prices.

Here’s a simple example to explain why:

If demand and supply for a particular commodity (such as crude oil) remain stable and the U.S. Dollar appreciates by 10%, then the commodity price also appears to rise by 10% in dollar terms. However, because there is no additional demand to support this higher price, the commodity price will eventually fall to reach a new equilibrium between demand and supply. This means commodity prices tend to move in the opposite direction to the U.S. Dollar.

AUDUSD and Gold Price Correlation

■ AUDUSD has a positive correlation with Gold

■ AUDUSD has had an 80% historical correlation to the Gold Price

🦘 Why the Australian Dollar is Correlated to Gold?

The Australian Dollar against the US Dollar is highly correlated with the gold price for several reasons:

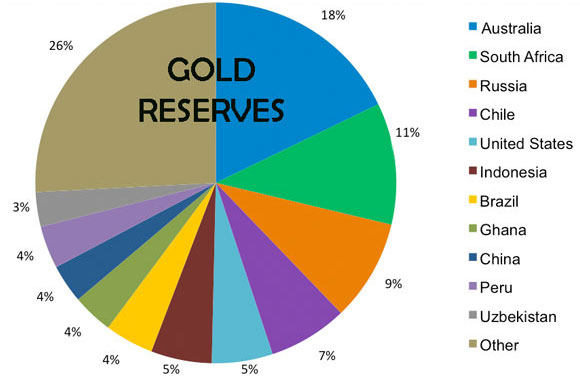

📌 Australia is a major gold producer, accounting for 9.4% of global production

📌 Australia’s gold reserves, at 9,800 tonnes, represent 18% of global reserves.

📌 The gold price is typically negatively correlated with the US Dollar.

Chart: Global Gold Resources

Source: United States Geological Survey (USGS)

Rating Formula Comparisons

Trade Strategy

Forex Brokers

💡 Forex Ratings

Forex Broker Ratings Powered by the Next-Generation RatingFormula 5.0 (?)

Forex Broker Ratings Powered by the Next-Generation RatingFormula 5.0 (?)

The RatingFormula series, developed by George M. Protonotarios, is designed to bring objectivity to online corporate ratings. In the future, search engines and various applications are expected to adopt similar rating algorithms to accurately assess the true value of online corporations for users and rank them accordingly in search results.