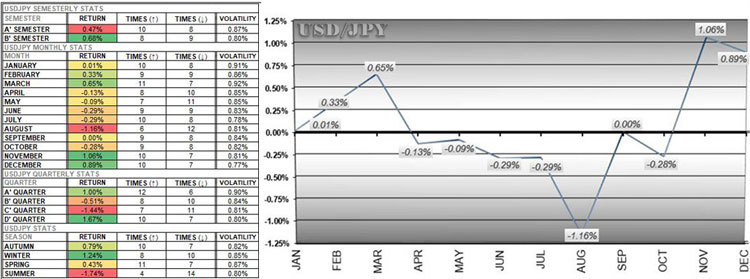

Forex Currency Stats

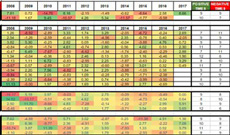

EURUSD STATISTICS & RESEARCH

EUR/USD is the undisputed leader in currency trading, offering maximum liquidity and tight spreads. It is an ideal Forex asset for scalpers and day traders. The pair becomes most liquid and active between 8:00 a.m. and 12:00 p.m. EST, when both the European and US markets are open

📈 EURUSD CHART

The following chart illustrates the average performance of EUR/USD throughout the calendar year, based on 17.5 years of data.

Chart: EURUSD Average Monthly Returns

Chart Source: ForexExperts (c)

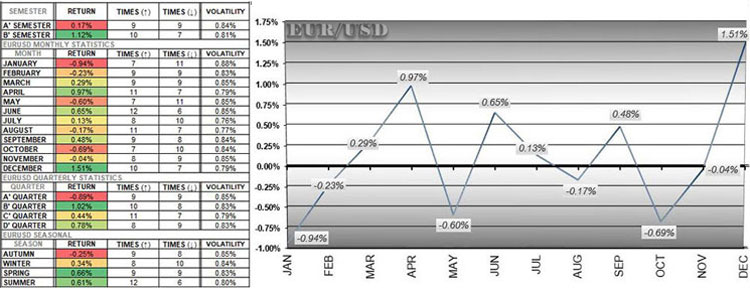

EUR/GBP is known as the fifth major, even though it is a Forex cross. The pair shows a positive correlation with EUR/USD.

📌 Tip: Consider going long on EUR/GBP as the calendar year ends, since it performs exceptionally well in November and especially in December.

📈 EURGBP CHART

The following chart shows the average performance of EURGBP throughout the calendar year.

Chart: EURGBP Average Monthly Returns

Chart Source: ForexExperts (c)

GBPUSD STATISTICS & RESEARCH

GBP/USD is the second most traded Forex pair after EUR/USD. It has a positive correlation with EUR/USD and a negative correlation with USD/CHF. GBP/USD is also commonly known as the "Cable."

📌 Tip: Consider going long on GBP/USD in April, as the pair averages a 1.53% gain during this month, with an impressive 16 positive months out of 18.

📈 GBPUSD CHART

The following chart shows the average performance of GBPUSD throughout the calendar year.

Chart: GBPUSD Average Monthly Returns

Chart Source: ForexExperts (c)

EURJPY STATISTICS & RESEARCH

The EUR/JPY pair consists of two reserve currencies—the Euro and the Japanese Yen. It is correlated with USD/JPY and tends to perform better during the last two months of the calendar year, especially in December.

📈 EURJPY CHART

The following chart shows the average performance of EURJPY throughout the calendar year.

Chart: EURJPY Average Monthly Returns

Chart Source: ForexExperts (c)

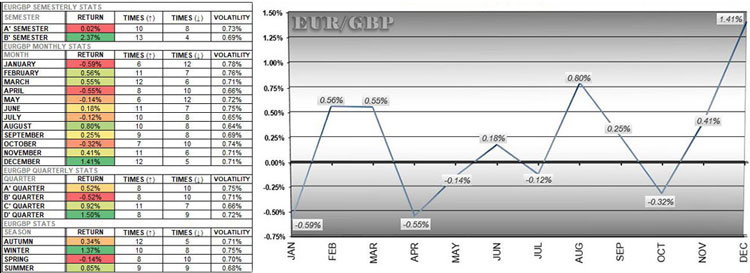

USDJPY STATISTICS & RESEARCH

USD/JPY is the third most traded Forex pair after EUR/USD and GBP/USD. Historically, USD/JPY tends to move in the same direction as the American markets (S&P 500, DJIA, NASDAQ). It also shows a positive correlation with USD/CHF and USD/CAD.

🔗Read more: ► Correlation Between USDJPY and US Stock Indices

📌 Tip: Go short on USDJPY in summer, as USDJPY performs -1.74% during summer, with 14 negative months out of 18.

📈 USDJPY CHART

The following chart shows the average performance of USDJPY throughout the calendar year.

Chart: USDJPY Average Monthly Returns

Chart Source: ForexExperts (c)

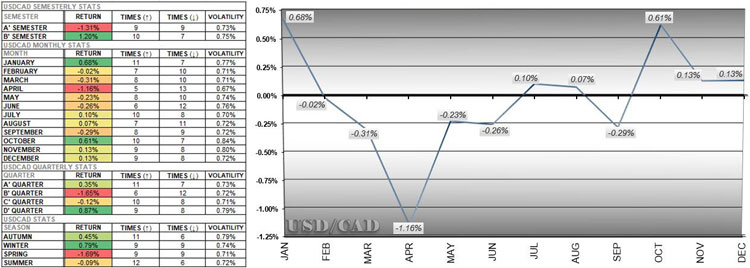

USDCAD STATISTICS & RESEARCH

USD/CAD is a Forex pair correlated with oil prices, as the Canadian economy exports oil to the US. Historically, there is a 0.75–0.80 positive correlation between USD/CAD and oil prices. USD/CAD is also correlated with CAD/JPY. Read more about the Crude Oil and USDCAD, CADJPY Correlation.

📈 USDCAD CHART

The following chart shows the average performance of USDCAD throughout the calendar year.

Chart: USDCAD Average Monthly Returns

Chart Source: ForexExperts (c)

USDCHF STATISTICS & RESEARCH

Both the Swiss Franc and the US Dollar are reserve currencies and are often regarded as 'safe havens' during global financial crises. US bond rates have historically shown a correlation with USD/CHF. Read more about the relationship between US Bonds Yields and the USDCHF.

📌 Tip: Go short on USDCHF before the last month of each semester (December and June).

📈 USDCHF CHART

The following chart shows the average performance of USDCHF throughout the calendar year.

Chart: Average USDCHF Monthly Returns

Chart Source: ForexExperts (c)

AUDUSD STATISTICS & RESEARCH

The Australian Dollar is a commodity currency, as Australia is a major gold exporter. Therefore, AUD/USD is correlated with the price of gold, showing an 80% historical correlation. The pair is also correlated with NZD/USD, EUR/USD, and GBP/USD. Read more about the AUDUSD and Gold Price Correlation.

📈 AUDUSD CHART

The following chart shows the average performance of AUDUSD throughout the calendar year.

Chart: AUDUSD Average Monthly Returns

Chart Source: ForexExperts (c)

Rating Formula Comparisons

Forex Brokers

💡 Forex Ratings

Forex Broker Ratings Powered by the Next-Generation RatingFormula 5.0 (?)

Forex Broker Ratings Powered by the Next-Generation RatingFormula 5.0 (?)

The RatingFormula series, developed by George M. Protonotarios, is designed to bring objectivity to online corporate ratings. In the future, search engines and various applications are expected to adopt similar rating algorithms to accurately assess the true value of online corporations for users and rank them accordingly in search results.