Trading the Market Sentiment

The Market Sentiment is a measure of what the majority of traders anticipate about the future course of the market.

The Market Sentiment actually refers to the psychology of the market. The market sentiment can be either: Bullish, Bearish or Neutral. Since the USD is involved in 80% of all Forex transactions, the Forex market sentiment is mainly focusing on the US Dollar.

General Market Sentiment Tools

Here are some popular Forex Market Sentiment tools, available on the internet:

■ Dukascopy Market Sentiment Tool

https://www.dukascopy.com/swiss/english/marketwatch/sentiment/?ibref=8411

■ FxStreet Market Sentiment Tool

https://www.dailyfx.com/sentiment

■ Oanda Forex Open Position Ratios

http://www.oanda.com/forex-trading/analysis/open-position-ratios

■ FXCM Speculative Sentiment Index (SSI)

https://www.fxcm.com/services/forex-trading-tools/ssi-speculative-sentiment-index/

Forex Correlated Sentiment Indicators

These are some important Forex Market Sentiment indicators:

- COT Analysis (Currency Futures)

- Open Interest (Currency Futures)

- Put/Call Ratio (Currency Futures Options)

- VIX Volatility (Info here http://forex-investors.com/index.php/forex-market/cboe-volatility)

Commitment Of Traders (COT) Report

The COT report is published weekly by CFTC and provides traders with detailed information about the opened positions in the US futures market.

www.cftc.gov/cftc/cftccotreports.htm

The COT Report presents three categories of opened positions:

- Commercial (Not-Important)

Positions of traders who use futures contracts for hedging against market risk.

- Non-commercial (Very-Important)

Positions of participants who speculate the market, such as investment banks, hedge funds, etc.

- Non-Reportable (Not-Important)

Positions of small speculators, such as retail traders.

The Importance of the COT Report

The COT report measures the market sentiment of the big players in the currency futures market. Currency futures constitute a centralized market.

In order to determine the market sentiment, you need to compute the difference in volume between the long and short positions. More about COT Reports here:

http://forex-investors.com/index.php/forex-market/cot

Other Ways to Measure the Market Sentiment

There are also alternative ways to measure the market sentiment:

- Business and Consumer Confidence Surveys

- Currency Indexes (for example the US Dollar Index), info here: http://forex-investors.com/index.php/forex-market/indices/usdx

- Market Response after News Release

- Market Response after the breaking of an Important Support or Resistance Level

- Divergence between News Release and Price Action

Business & Consumer Confidence Surveys

There is a great number of business and consumer confidence surveys released periodically to the general public. Here are some of the more important economic surveys:

- US University of Michigan Consumer Sentiment: http://www.sca.isr.umich.edu/

- US Chicago Purchasing Managers Index: https://www.ism-chicago.org/insidepages/reportsonbusiness/

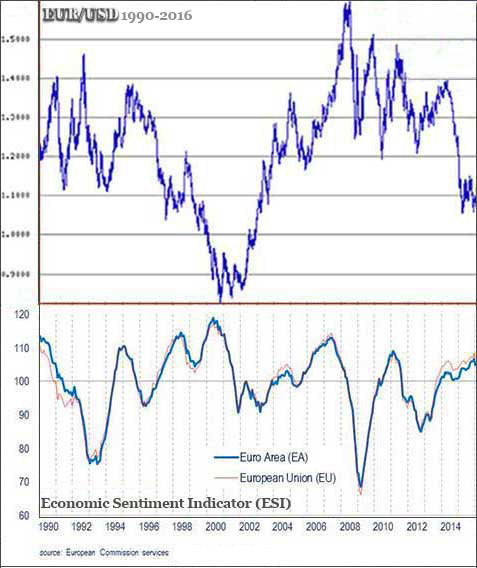

- European Business and Consumer Surveys (CHECK CHART BELOW): http://ec.europa.eu/economy_finance/db_indicators/surveys/index_en.htm

- German Sentix Investor Confidence: https://www.sentix.de

- German ZEW Economic Sentiment: http://www.zew.de/en/

- Australian NAB Business Confidence: http://business.nab.com.au/tag/business-survey/

- Australian Westpac Consumer Sentiment: http://www.westpac.com.au/

- Bank Of Canada Business Outlook Survey: http://www.bankofcanada.ca/publications/bos/

- New Zeeland NZIER Business Confidence: http://nzier.org.nz/

- Japan Consumer Confidence Index: http://www.esri.cao.go.jp/en/stat/shouhi/shouhi-e.html

Chart: EURUSD vs the European Sentiment Index (1990-2016)

More: » Breakout Strategy | » Forex Fundamental Analysis | » Carry Trading | » EA Builder Tester

REVIEW BROKERS: » IC Markets | » FP Markets | » AXI | » Dukascopy | » FBS

■ Trading the Market Sentiment

ForexExperts.net